THÔNG BÁO

Đánh giá tổng thể luận án tiến sĩ của NCS Ngô Tiến Chương

Viện Tài nguyên và Môi trường, Đại học Quốc gia Hà Nội tổ chức phiên họp Hội đồng đánh giá tổng thể luận án tiến sĩ cho nghiên cứu sinh Ngô Tiến Chương. Tên đề tài luận án: “Nghiên cứu phát triển hệ thống nuôi tôm - lúa hữu cơ bền vững tại huyện Thới Bình, tỉnh Cà Mau”. Chuyên ngành: Môi trường và phát triển bền vững. Mã số: 9440301.04. Thời gian: 14h00, thứ bảy, ngày 06/4/2024. Địa điểm: …

TIN TỨC VÀ SỰ KIỆN

Hội thảo Nâng cao năng lực quản lý tài chính, hành chính của Viện Tài nguyên và Môi trường, ĐHQGHN

Ngày15/4/2024, Viện Tài nguyên và Môi trường đã tổ chức Hội thảo Nâng cao năng lực quản lý tài chính, hành chính của Viện TN&MT trong khuôn khổ Dự án "Nâng cao năng lực quản lý tài chính, hành …

Bài viết mới

Hội thảo Nâng cao năng lực quản lý tài chính, hành chính của Viện Tài nguyên và Môi trường, ĐHQGHN

Ngày15/4/2024, Viện Tài nguyên và Môi trường đã tổ chức Hội thảo Nâng cao năng lực quản lý tài chính, hành chính của Viện TN&MT trong khuôn khổ Dự án "Nâng cao năng lực quản lý tài chính, hành chính" được tài trợ bởi Tổ chức Liên minh Bảo tồn Thiên nhiên Quốc tế (IUCN). Hội thảo được tổ chức nhằm chia sẻ những bài học kinh nghiệm và ứng dụng thực tiễn kiến thức quản lý hành chính, tài chính từ …

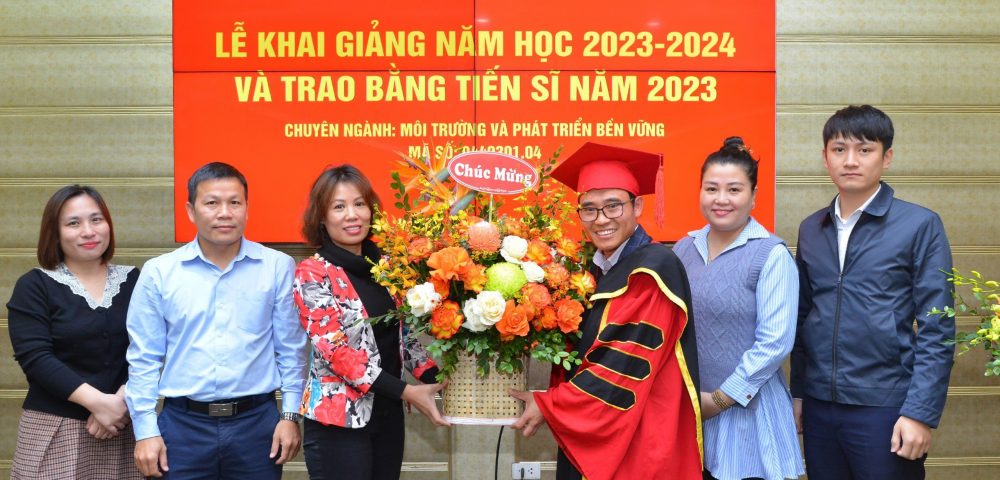

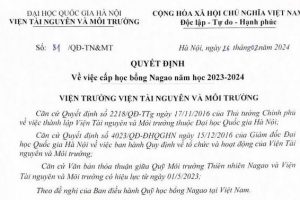

Lễ trao học bổng Nagao năm học 2023-2024

Ngày 03 tháng 4 năm 2024, Viện Tài nguyên và Môi trường, Đại học Quốc gia Hà Nội (Viện TN&MT), long trọng tổ chức Lễ trao học bổng NAGAO năm học 2023-2024 cho các học viên cao học. Tham dự buổi lễ về phía khách mời có, TS. Trần Nam Tú – Phó Vụ trưởng, Vụ KHCN và Môi trường, Bộ GD ĐT; PGS. TS. Nguyễn Anh Tuấn – Trưởng ban Đào tạo, ĐHQGHN; Về phía Viện Tài nguyên và Môi trường có: GS.TSKH …

Chứng nhận VIMCERTS 327

Ngày 26/3/2024, Viện Tài nguyên và Môi trường, Đại học Quốc gia Hà Nội chính thức được cấp chứng nhận VIMCERTS 327. Với Giấy chứng nhận số 17/GCN-BTNMT của Bộ TNMT, Viện đã đủ điều kiện để thực hiện hoạt động dịch vụ quan trắc môi trường. Phạm vi quan trắc gồm nước mặt với 8 chỉ tiêu đo đạc tại hiện trường, 31 chỉ tiêu phân tích tại PTN; nước dưới đất với 8 chỉ tiêu đo tại hiện trường, 34 chỉ tiêu …